The services offered include:

- Customer global position view/Balance enquiry

- One Time Pin Authentication (OTP capability)

- Multi-format statement viewing and statement download

- Internal Funds Transfer (IFT)

- Electronic Funds Transfers (EFT)

- SWIFTS and RTGS

- Cross currency transactions

- Bulk Payments

- Pesalink Transfers

- Mobile Money Transfers

- Bill processing & Utility Payments

- Merchant Payment (Pay to Till/Paybill)

Self – registration for individual customers:

- Click on NATONLINE

- Select REGISTER

- Provide your Identification /Passport number and the NBK Bank Account number

- Follow the prompts and receive your user ID plus password.

- Proceed to login and access your profile.

List of Services in Progress Coming Soon

- Card Payments

- Trade Finance

- Liquidity Management

- Cheque Book services

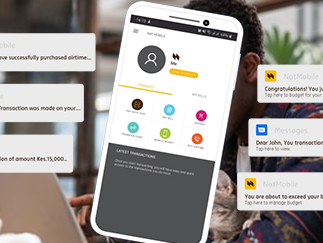

Personal Internet Banking

Save time and carry out multiple functions at the convenience of your internet enabled device. It’s fast and efficient, allowing you to access all your account easily.

The services offered include:

- Customer global position view/Balance enquiry

- One Time Pin Authentication (OTP Capability)

- New design statement viewing and generation

- Internal Funds Transfer (IFT)

- Electronic Funds Transfers (EFT)

- SWIFTS and RTGS

- Cross currency transactions

- Bulk payments

- Mobile Money Transfers

- Pesalink Transfers

- Bill processing & Utility Payments

- Merchant Payment (Pay to Till/Paybill)

What is required

To register, please visit your nearest branch with your ID/Passport

Corporate Internet Banking

Our corporate clients also have the luxury of banking at their convenience. With enhanced security features we ensure no customer information is compromised or intercepted by unauthorized parties. To ensure that you have control, the system can mirror management of multiple users having varying levels of authority as organizations may require.

We offer two levels of service:

Transactional based services

- Fund transfers between customer own accounts

- Funds transfer to third parties, including bill payments, RTGS and SWIFT/ telegraphic/wire transfers

- Bulk payment processing including Pesalink and Mobile Transfers

- Setting up of standing orders

- Salary processing and Suplier payments

Non-transactional services

- Viewing account balances

- Viewing transactions

- Downloading bank statements in various formats

- Ordering cheque books

- Stopping payment of cheques